PautaInternas

PautaInternas

Climate change adaptation

Climate change adaptation

Climate change adaptation

May 23, 2025

Climate change adaptation

The increase in the concentration of GHG emissions contributes to the increase in the average global temperature of the planet, which results in the modification of temperature and precipitation patterns of territories in future periods of time. This effect is known as climate change, which, consequently, will increasingly affect the different systems (human, natural, productive), making it necessary to adapt to this new climatic dynamic.

Climate Horizons

Climate Horizons

Ecopetrol has identified the risks and opportunities related to climate, physical and transition, as well as the potential impacts and benefits in the following horizons:

|

Short term (to 2030) |

The short-term horizon is used to review dependencies, impacts, risks, and opportunities in line with the climate change roadmap. This horizon considers the following aspects: i) establish and achieve annual GHG emission reduction targets in line with the Decarbonization Plan, Water Neutrality and Biodiversity; ii) identify short-term risks and establish mitigation actions, controls and Key Risk Indicators (KRIs); and (iii) identify and implement cost-effective opportunities to contribute to GHG emission reduction targets |

|

Medium term (to 2036) |

The medium-term horizon is used to identify emerging risks that will affect the company in the next 5 years or more and review the portfolio of diversification opportunities. |

|

Long term (2037+) |

The long-term horizon is used to analyze market trends, policy and regulatory changes, and emerging technological developments that may affect the company's climate ambition and long-term business strategy. |

Physical risks and adaptation

Physical risks

Physical risks

Physical risks derived from climate change can cause events (acute) or long-term (chronic) changes in weather patterns. Physical risks can have financial repercussions for the company such as direct damage to assets or indirect impacts caused by interruptions in the production chain.

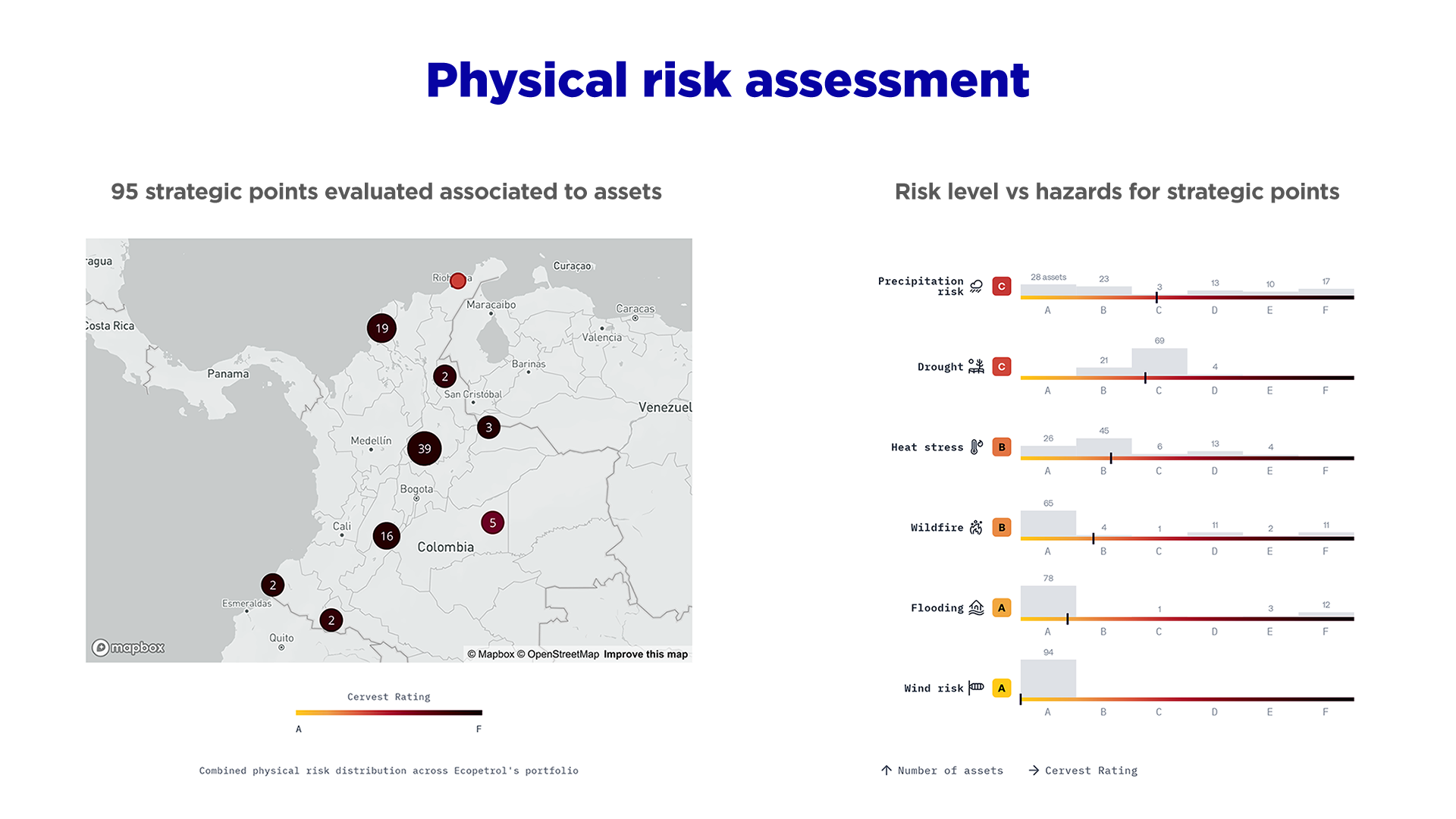

Ecopetrol developed the physical risk assessment of the company’s assets in Colombia to understand Ecopetrol’s vulnerability to future climate scenarios. The analysis uses regional climate models with various datasets to analyze the assets’ physical vulnerability related to the potential impact of climate hazards. There is information of seven risks related to chronic hazards (drought, and heat stress) and acute hazards (precipitation, coastal flooding, riverine flooding, wildfires, and wind), under three IPCC climate scenarios to the year 2100, covering the lifetime of the main assets:

- SSP 5 (RCP 8.5), which shows the emissions trajectory under a business-as-usual scenario.

- SSP 2 (RCP 4.5), which shows the emissions trajectory achieving a stabilization in temperature increase at 2°C, with peak emissions in 2040.

- SSP 1 (RCP 2.6), which shows the emissions trajectory achieving a stabilization in temperature increase at 1.5°C, aligned with the Paris Agreement target.

In a critical scenario (business as usual), increases in maximum temperatures and in heat waves duration pose the greatest hazards to the entire asset portfolio. These are the most significant risks in terms of worker safety and even operational disruptions. However, it is not expected to have direct impact on infrastructure. In addition, six locations have a substantially higher risk of coastal flooding and more moderate river flooding is expected at four locations. The remaining climate hazards are not expected to increase substantially across the portfolio.

Climate variability

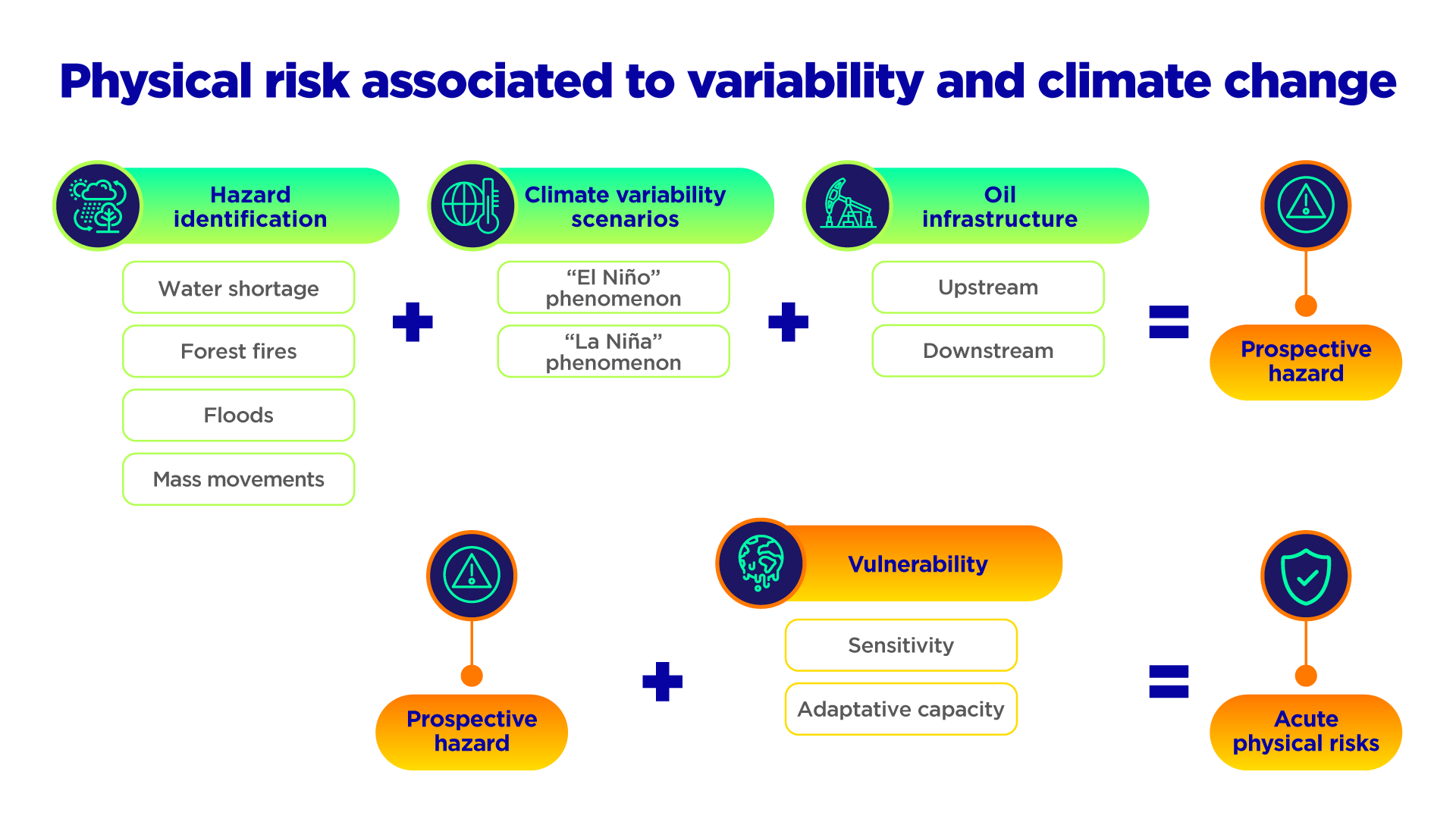

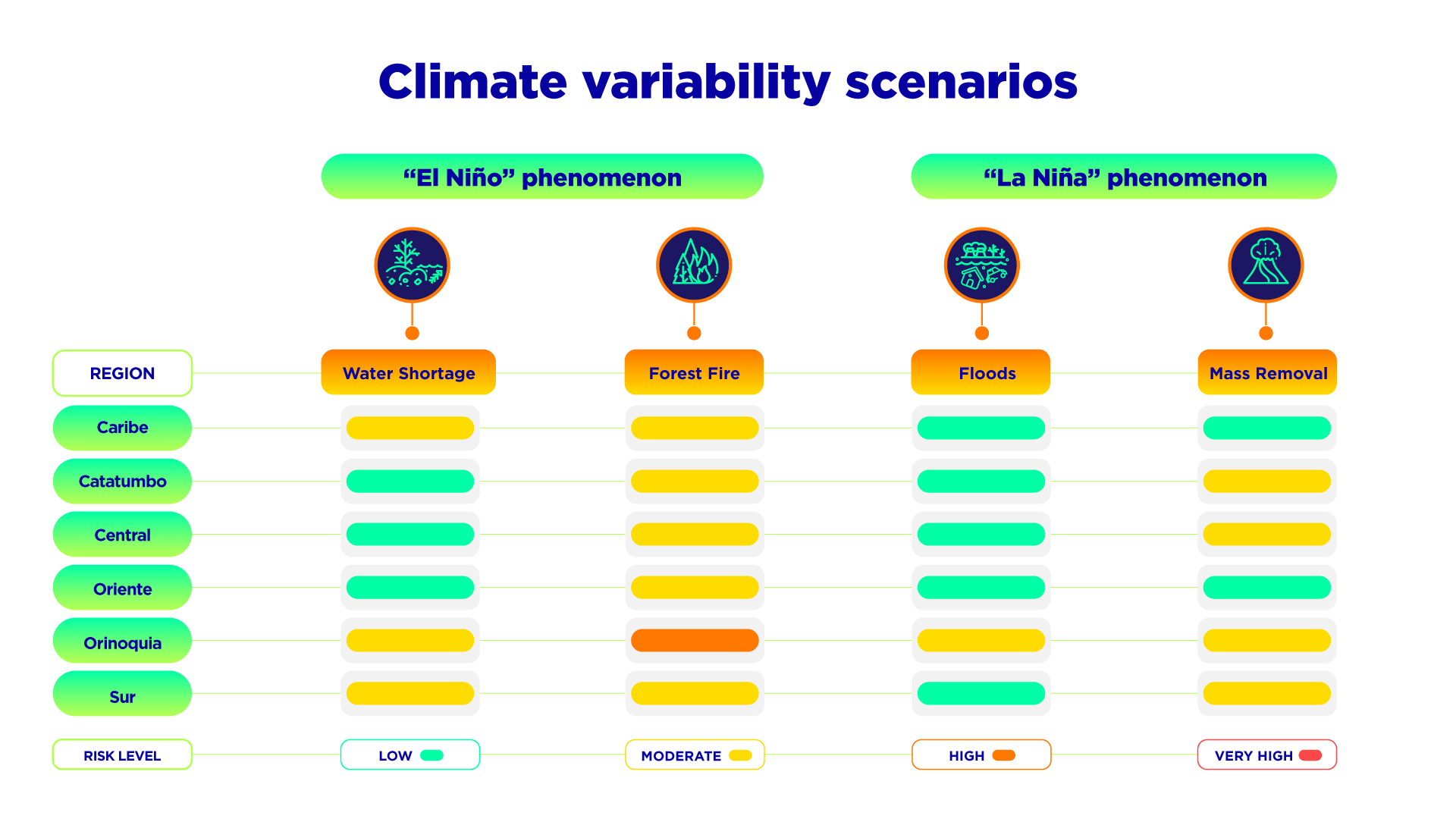

Regarding acute physical risks, these represent a greater vulnerability for the company due to their intensity and frequency, which materialize with the occurrence of phenomena such as "El Niño" and its opposite phase "La Niña". In this context, Ecopetrol has a specific analysis at regional level, using the RCP 6.0 scenario in line with the Climate Change Management Plan of the Mines and Energy sector and the Third National Communication on Climate Change, based on the following model:

The level of climate risk in climate variability scenarios is presented in the following graph:

Further information, please see in detail: Acute physical risk analysis at regional level.

Adaptation

To manage physical risks, Ecopetrol has adaptation plans that include short, medium, and long-term measures in the following components:

|

Water resource management |

||

| Objective: Reduce the vulnerability to variability and climate change for water scarcity and floods. | ||

|

Short term (< 3 years) |

|

|

|

Medium term (3 - 5 years) |

|

|

|

Long term (> 5 years) |

|

|

|

Strategic ecosistems restoration and conservation |

||

| Objective: Reduce vulnerability in strategic ecosystems for operations through conservation, restoration and recovery. | ||

|

Short term (< 3 years) |

|

|

|

Medium term (3 - 5 years) |

|

|

|

Long term (> 5 years) |

|

|

|

Climate resilient infrastructure |

||

| Objective: Reduce the vulnerability of Ecopetrol facilities due to the impacts generated by extreme weather events. | ||

|

Short term (< 3 years) |

|

|

|

Medium term (3 - 5 years) |

|

|

|

Long term (> 5 years) |

|

|

|

Climate compatible operation |

||

| Objective: Strengthen operational capacities to deal with the effects of variability and climate change. | ||

|

Short term (< 3 years) |

|

|

|

Medium term (3 - 5 years) |

|

|

|

Long term (> 5 years) |

|

|

Transition risks and opportunities

Transition risks

Transition risks

The transition to a low-carbon economy may entail political, legal, technological, and market challenges to address mitigation and adaptation requirements related to climate change. Depending on the nature, speed, and approach of these changes, transition risks can pose financial and reputational risks of different levels for organizations.

Ecopetrol carried out a prioritization of transition risks, identifying the following:

|

Market risk |

||

|

Pathway |

|

|

|

Potential impact |

|

|

|

Regulatory risk |

||

|

Pathway |

|

|

|

Potential impact |

|

|

Other identified risks are:

- Legal risk, associated with negative reactions and lawsuits against Ecopetrol S.A.'s climate action.

- Risk of assets trapped in the traditional business of hydrocarbon production, transportation, and refining, considering factors such as fuel demand prospects and asset profit horizons.

- Reputational risk, Reputational risk, associated with the impossibility of responding in a timely way to the expectations and demand of investors and other interest groups to establish ambitious objectives regarding climate change, which would affect the company’s image and brand.

- Technological risk, associated with the negative effects on the profitability of the business if there is no preparation and capacity to adapt to new technologies because of the transition process.

Transition scenarios

In 2023, the construction of energy transition scenarios began, which aims to be a solid and unified reference framework that allows the Ecopetrol Group (EG) to anticipate and understand the challenges and opportunities of the energy transition, through the presentation and comparison of three scenarios: Climate Alignment, Energy Balance and Climate Divergence.

- Climate Alignment (1.7° - 1.8°C): Transformation to low-emission economies aligns governments and institutions around climate change. In addition, developed countries reach Net-, while other countries follow a slower path. This is not enough to achieve the global net-zero ambition (1.5 ℃).

- Energy Balance (1.9° - 2.3°C): Fundamental changes in governments, markets, and society set in motion a long-term energy transition, the debate continues between energy security and accelerating the transition.

- Climate Divergence (2.5° - 2.8°C): Dissimilar interests in decarbonization despite policy, regulation, and market changes. Global public policy decisions are insufficient to close the climate ambition gap.

Ecopetrol considers it relevant to compare three possible scenarios. Although the first and third scenarios do not reflect the group's base vision, assessing different perspectives on the global energy transition remains necessary. According to the strategic 2040 outlook, Ecopetrol considers the second scenario the most likely, aligning with a gradual energy transition. This transition envisions increased use of low-emission energy sources while retaining conventional energy in the overall energy mix.

For the construction of these scenarios, the projections of the reports “World Energy Outlook”, by the International Energy Agency (IEA), and “New Energy Outlook”, by BloombergNEF, among other sources, were consulted. Thus, the Energy Balance and Climate Divergence scenarios are aligned with the IEA's Announced Commitments Scenario (APS) and Stated Policy Scenario (STEPS), respectively; In addition, information from BloombergNEF is used to include aspects of transmission, electricity, industry, buildings, and transportation.

For further details, see TCFD Report Ecopetrol 2023

Opportunities

The efforts made to mitigate and adapt to climate change also create opportunities for companies, to identify and develop opportunities through resource efficiency and cost savings, the adoption of low carbon energy sources, the development of new products and services, access to new markets, and creating resilience throughout the entire production chain, will generate sustainability for the business.

Ecopetrol has identified the following opportunities arising from climate change, which are aligned with the company's corporate strategy.

|

Energy source |

||

|

Ongoing opportunities |

|

|

|

Benefits |

|

|

|

Resource efficiency |

||

|

Ongoing opportunities |

|

|

|

Benefits |

|

|

|

Products, services, and markets |

||

|

Ongoing opportunities |

|

|

|

Benefits |

|

|

. . .